Tesco Business Strategic Report 第二部分

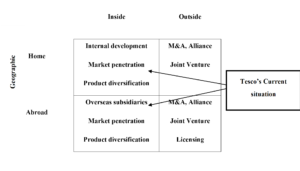

2.0 Ansoff Matrix

|

|

| |||

2.1 Market penetration

As a strategy, most companies have acknowledged that customers run after brand, but not products; as a result, they sell brand prior to the product. Tesco sells its brand before its product, and its brand has become a household name in the target market. Tesco entered the target market using a self-advertising website. In addition, the company promoted itself through the website, as well as leafleting in its stores.

In 1995, Tesco transverse the Sainsbury, which made it become the largest retailer in the United Kingdom. Its club card scheme is the largest trump card in its target markets, and from this card, the company is able to gain increased loyalty from its customers, as well as to find a way of penetrating into the unexploited markets (Brannen, Moore, Mughan 2013, p. 295).

2.2 New products and services

Product development is the key strategic tool for any industry, in which 25% of the overall business performance are dependent on it. Over the years, Tesco has increasingly expanded its product and service offerings. Having commenced with food commodities during its inception, Tesco today has wide-ranging products and services, including electronics, insurance, mortgages, credit card loans, saving schemes, and it is also working to increase the food product line varieties.

In addition, the company has also introduced biofuel products to replace petrol and diesel, and it is increasingly working to improve the quality of its products. Also, the company is also working to expand into the telecommunication sector through launching a variety of telecommunication products (Plimmer 2010, p. 377).

2.3 Market development

The company has been very keen on pursuing its growth and development through investments and acquisitions. Among the companies it has acquired over the years include the Scottish chain of supermarkets, William Low, as well as two Ireland supermarkets, including Quinnsworth and Stewarts.

In addition, Tesco also purchased the Casinos Leader chain of supermarkets in Poland, which were subsequently reconfigured as sizeable Tesco stores. Furthermore, Tesco often continues to make remarkable changes of diversifying its businesses, which, for instance, include expanding to global markets like South Korea, Poland, and Japan.

2.4 Diversification

In the recent years, Tesco has increasingly diversified its business, in which it has extended from food products to non-food items. Originally, the company mainly concentrated on food products. But later on, the company began to diversify into areas such as clothes, internet services, financial services, DVD sales and rent, as well as consumer dental plan.

In these new product segments, the company heavily built its experience in private labels. For instance, the company used its strong food brand “value” and “finest” to non-food brands so as to enhance their market performance (Flavián, Haberberg & Polo 2002, p. 134).

3.0 BCG Matrix

Prior to looking at the BCG matrix, it is important to analyse the business growth of Tesco in various global target markets:

| Countries | Revenues | Revenue growth | Trading profits | Trading profit growth | Marketing position | Loyalty scheme members |

| United Kingdom | £44 billion | +2% | £2270 million | 8% | 1st | 15 million |

| Asia | £12 billion | +6% | £660 million | 10% | 2nd | 20 million |

| Europe | £9 billion | +6% | £330 million | 38% | 2nd | 8 million |

The following chart outlines the elements of the BCG matrix as attributed to Tesco’s current situation:

3.1 Star

The Star aspect of the company indicates high growth and market share. Essentially, Tesco commenced its business as a food retailer, and consequently it diversified into other fields, including the petrol sector, telecommunication sector, and banking services. The company’s market share is at all times high due to its strong brand.

3.2 Question mark

The aspect of the question mark in Tesco indicates high growth, as well as small market shares. This is particularly in the Asian target markets, whereby, although people are going to buy products from Tesco, the market share is still low due to the increased competition.

In addition, the company is facing difficulties in marketing its telecommunication products. Since its main business is retailing, the company is finding it hard to grow its profits in the Asian market due to the presence of strong competitors like Samsung and Jazz (Plimmer 2010, p. 378).

3.3 Cash cow

Regarding the cash cow aspect, the company experiences high share prices and lower growth. This aspect is mainly attributed to the European market where the company takes advantage of its strong brand name to overshadow competitors. This enables it to overshadow its competitors.

3.4 Dogs

The aspect of dogs, Tesco can be attributed to low growth and low market share, particularly in its banking sector in USA. As a result of low growth and low market share, the company deliberated on an exit plan in this market.

Essay Only – 专业论文定制

代写,让大学生活更美好!