The manufacture of motor vehicles industry analysis in the United Kingdom 第一部分

Content Page:

- Industry identification

- Introduction

- Structure of the UK motor vehicle industry

- Porter’s Five Force Analysis

4.1. Threat of new entrants

4.2. Bargaining power of suppliers

4.3. Threat of substitute

4.4. Rivalry among Firms

4.5. Bargaining power of buyers

- Micro and macro-factors Changes

- PESTEL Analysis

6.1. Political Factors

6.2. Economic Factors

6.3. Social Factors

6.4. Legal Factors

6.5. Technological Factors

6.6. Environmental Factors

- Analysis and the Effects

- Conclusion

- Reference

1. Industry identification

This report focuses on the manufacture of motor vehicles (Group 29.1) which is under Division 29 (Manufacture of motor vehicles, trailers and semi-trailers) in UK standard industrial classification (SIC) hierarchy (Office for National Statistics, 2007).

2. Introduction

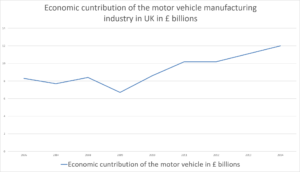

The automobile industry, as one of the present industry in the worldwide community today, has changed the way people lived and brought a significant economic contribution to many nations. Ever since the creation of first modern car by Benz and Daimler in the late 18 th century, the industry has grown into a billion pounds industry affecting so many aspects of life around the world. In the UK, the motor vehicles industry contributed 12 billion p ounds to the UK economy in 2014. The industry contributed 8 percent of the total manufacturing output in the year and employed 1.5 million people. 1.6 million Automobiles were produced and 78 percent of them exported during the operations year 2014 (Rhodes &Sear, 2015). The chart below indicates that there was a significant fall in output in the industry during the economic recession of 2008 and 2009 experienced after the world global crisis. The following years, however, saw a steady recovery in the industry that only stagnated in 2011 before regaining the growing momentum. In 2014, the output reached the highest level than in any other year since 2006. Currently, the future of the UK automobile industry indicates tremendous growing potential. This report looks at the structure of the UK automotive industry; both micro and macro environmental structural analysis and the future of the industry.

Source: Office for National Statistics (2015)

3. Structure of the UK motor vehicle industry

The automobile industry in the UK is currently known for its premium vehicles coupled with lots of sports car. This classification is dominated by local manufacturers such as Land Rover, Daimler, Jaguar and Morgan among other prestigious manufacturers. There is a strong presence of foreign manufacturers in the industry which is mainly volume manufacturers. The volume manufacturers include Honda, Toyota, Nissan and Adam Opel AG that owns Vauxhall Motors. The major three manufacturers of the most common include the Nissan Motors Manufacturing UK, Toyota UK and Ford (Ford Britain). These firms could be major but act as competitors against each other as well as against other companies in the motor industry.

The general macro environment factors in any industry include; political factors, economic factors, socio-factors, technological factors, legal factors and environmental factors (PESTLE). These are expected to affect any industry, this motor industry no exception.

4. Porter’s Five Force Analysis

In this section, we look at the analysis of the industry in relation to Porters’ five forces of the market.

4.1. Threat of new entrants

For this specific case, the threat of new entrants is low. The market has seen an entry of new competitors over the recent years which have taken up a considerable market share previously held by the veterans.

Giant leading firms existing in the industry pose a major challenge to any new entrants. To penetrate large amounts of investments are required to invest in worthwhile manufacturing plants, conduct intensive research and design processes, recruit and train proper and skilled workers among other needs. A number of innovations in the industry are also capital intensive where the UK market is currently in need of mass production to address the needs of the average and low-income earners.

The producers also need to achieve economies of scales. In another word, they are required to be able to mass-produce so that they can make cars affordable to target consumers. This can be one of the important barriers for prospective motor vehicles producer.

The ability to access distribution channels is another barrier. It is hard to find an adequate means of distribution for a new company as the space of dealership lot is limited.

4.2. Bargaining power of suppliers

There are lots of suppliers in the UK motor market. If one supplier does not meet the requirements of automotive company, it is easily replaced with another. The market favours low bid suppliers which enable them to save on manufacturing costs.

Considering the market is of free nature, the manufacturers are able to assess the various raw material suppliers and pick out those selling at minimum prices.

In the case, a supplier sets high prices and the supplier element in the industry is distorted and characterised by high prices, manufacturers’ returns decline reducing profitability.

The higher the supplier bargaining power in the industry, the lower the amount of returns realised by the companies in operations.

4.3. Threat of substitute

The threat of substitutes in the motor industry is relatively high with the effective and well-organized public transport system. The system comprising of public buses and trains significantly contribute to low buying volumes of motor vehicles.

There is a booming market in the industry for second-hand vehicles that are far much cheaper which sees many car buyers taking to these second-hand options. In this case, trade volumes of new vehicles by manufacturers fall significantly. The existence of these manufacturers is threatened by substitutes.

4.4. Rivalry among Firms

Consumers in the recent years have a tendency of keeping their automobiles for longer periods, and being more prudent and judicious when buying new ones. Strategically, the opportunity is for the industry to focus on fuel efficiency and price sensitivity strategies more fully to shift from profit and production models previously centred on trucks and SUV’s. By use of these strategies, the manufacturers are likely to attract more customers. The number of vehicle manufacturers in the UK motor industry has risen significantly over the years which see rivalry rates rise in response. Major firms no longer hold client security as a result, which requires them to use more innovative strategies to maintain their market targets.

Even though it is hard to form a new company in this particular industry, many foreign companies, which are already well developed in their own countries, will become strong rivalries in the market as they are having the required capital, technologies and managerial skills.

4.5. Bargaining power of buyers

When customers can access the vehicles at much lower prices elsewhere, the companies make low returns. When clients in this market have high bargaining power, the sales revenues take a downward trend thus affecting company profitability. Manufacturers must, therefore, ensure that their pricing strategies take care of the strong bargaining tendencies for them to avoid running into operating losses.

The higher the bargaining power by buyers, the further downwards does the manufacturers’ revenues look.

Essay Only – 专业论文定制

代写,让大学生活更美好!